Don’t panic if a contractor tells you they are going to lien the property

At some point, you could get dissatisfied with something that has gone wrong.

While you may have a good reason for enforcing the contract and withholding payment, a contractor can try to pressure you to hurry up and pay. They might do this by ‘dropping by’ and letting you know that they are on their way to put a lien on your property and the only thing that will stop them is a check.

Most people panic, hurry up and cut a check, while listening to the contractor tell them how they are going to fix everything and finish up soon, which doesn’t end up happening.

If you want to maintain control, that is the wrong thing to do. If this happens to you, don’t panic; here’s why…

While both the contractor and subcontractor, who work on your property, can put a lien on the property for any unpaid amounts. Though the process is generally simple, there are very specific steps contractors must take in order for their lien claim to be valid in their state.

- The contractor must officially request payment.

- The owner must refuse to pay for completed work without cause.

- The contractor must wait the contractually required amount of time for payment to become overdue.

- The contractor must provide legal notice of overdue payment after payment is contractually overdue and within the days required by the state.

- The contractor must wait an additional state specified number of days, prior to filing the lien.

While requirements vary from state to state, the point is there are some important steps that prevent contractors from simply going to the city to file a lien.

Here’s what you should do:

If there is cause for withholding payment and the contractor has not already sent you a letter, send them a certified letter notifying them of the deficiencies. Cite the scope of work, what is wrong, and what needs correcting legally documents your position. Doing it before the contractor sends you a certified letter of non-payment, gives you the edge.

Be clear and as detailed as possible; this letter put power back in your hands. If you put everything that you notice (and do look for everything) you can always negotiate away items that might later seem unreasonable. If you forget something and you find it after the money is finally paid, or worse, you notice it but figure it’s no big deal, you’ll have to live with it.

Make sure in the letter that you state that you are willing to pay them for work completed as soon as they make the necessary corrections. This is important so they can’t say that you won’t pay them. Then, if you haven’t done it already, get in touch with the building department in your local city and find out the details for your state.

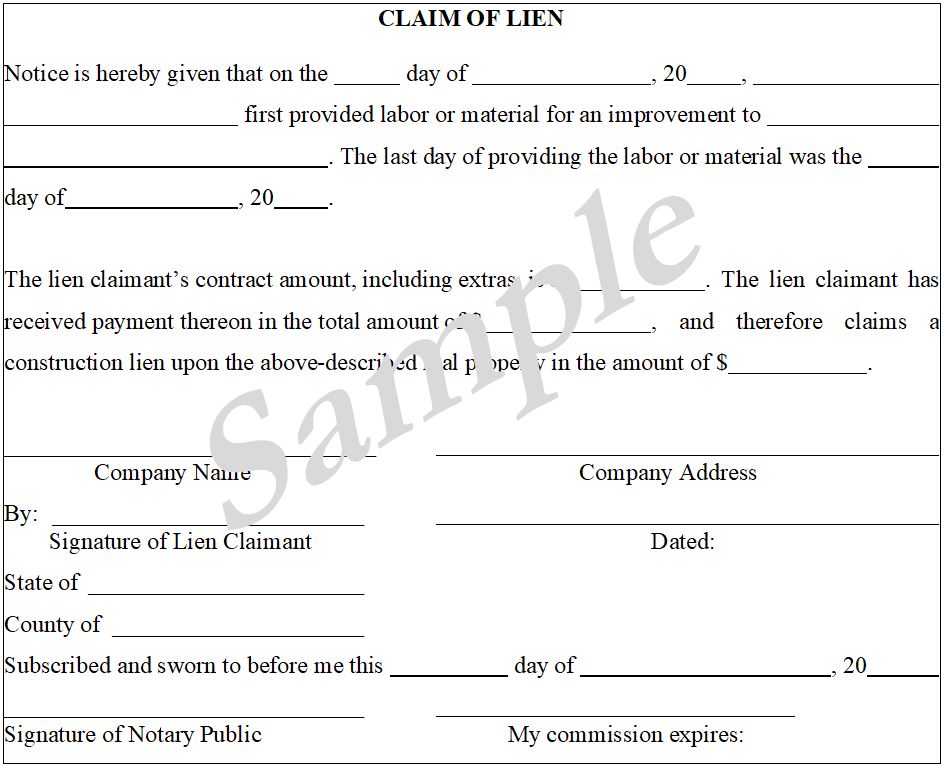

If it goes so far that the contractor is serious about placing a lien on the property, they should deliver you a letter that looks a little like the following figure:

Figure 8. Contractors Claim of Lien

Not all states follow this format. In order for the lien claim to be legal it must include: issue date, date of contract commencement, date of work stoppage, total contracted amount, total payment amount, remaining payment amount, total lien amount, company name, company address, authorized signature of lien claimant, date of signature, and must be executed by a Notary Public.

All of that information is important for the state to record the lien. If you receive or have received a letter like this and it does not include all of this information, it is most likely not a legal notification.

Even if a lien is applied, the state often stipulates that upon payment contractors must issue documentation to remove their lien. It is always a good idea to put it into writing that the contractor should provide a lien waiver for amount of payment and that they remove any filed liens within 48 hours of payment. Once the lien amount is paid, the lien is usually easily and quickly removable.